What is SASA?

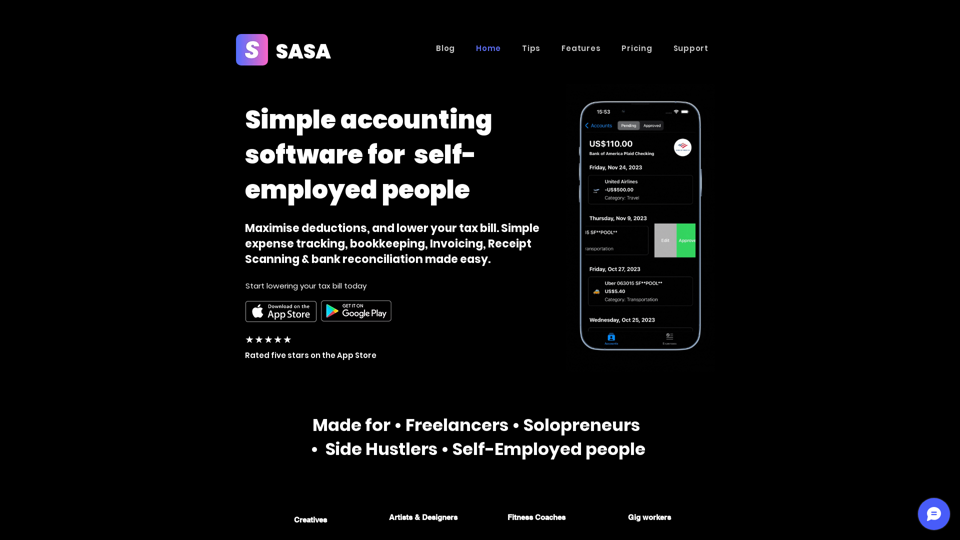

SASA is a straightforward accounting software application designed specifically for self-employed individuals, freelancers, solo entrepreneurs, and side hustlers. It provides an all-in-one solution for bookkeeping, invoicing, receipt scanning, and bank reconciliation, making it easy to manage finances and maximize deductions.

Features of SASA

Bank Reconciliation

- Connect with over 20,000+ banks

- View all your accounts in one place

- Secured by Plaid

Expense Tracking & Bookkeeping

- Link your bank or credit card account

- Effortlessly swipe through expenses

- Easily separate business and personal expenses

Receipt Scanner

- Take a picture of your receipt

- SASA will automatically extract data using AI

- Stay prepared for tax season

Simple Invoice Maker

- Create invoices in seconds

- Always look professional

- Send estimates, track invoices, and get paid faster

Expense Report Maker

- Create expense reports for clients

- Export as PDF, XLS, and CSV

- Get paid faster

Export Expenses

- Export expenses as a simple CSV for your accountant

- Tax season is taken care of!

Get Notifications & Reminders

- Stay on top of things

- Receive notification reminders

- Stay prepared for tax season

Pricing

SASA offers a free trial, and you can start using the app without a credit card. Learn more about SASA's pricing and features.

Helpful Tips

- Use SASA to maximize your deductions and lower your tax bill.

- Take advantage of the daily expense tracking and bookkeeping features to stay organized.

- Utilize the receipt scanner to keep track of your receipts and stay prepared for tax season.

Frequently Asked Questions

What is SASA used for?

SASA is used for simple accounting, bookkeeping, invoicing, receipt scanning, and bank reconciliation for self-employed individuals, freelancers, solo entrepreneurs, and side hustlers.

Is SASA secure?

Yes, SASA is secured by Plaid, ensuring the safety and security of your financial data.

Can I export my expenses from SASA?

Yes, you can export your expenses as a simple CSV for your accountant, making tax season easier to manage.